With the launch, at the end of August 2023, of “Osez L’Export,” the French government’s sweeping and admirably ambitious plan to support and empower the country’s export sector, this is an appropriate time to frame this drive in the context of “national brands” and the related Country Of Origin (COO) effect on the export attractiveness and potential of French goods and services.

With respect to brand equity, the position of France as a national brand is strong, and has even improved in recent years. The 2022 edition of the annual Anholt-Ipsos Nation Brands Index, a global survey which evaluates the international image and reputation of 60 nations across six dimensions of national competence (Exports; Governance; Culture; People; Tourism; and Immigration and Investment) saw France move from sixth to fifth place overall, while the BrandFinance consultancy’s 2023 Nation Brands ranking, which attempts to place a monetary value on national brands, has France steady in sixth place, the same as its 2022 evaluation, among all nations ranked.

The leading French exporters – a highly diverse group encompassing sectors like energy, pharmaceuticals, chemicals, aerospace, food products, automobiles, beverages, and fashion – are all multinationals with extensive international operations, dozens of foreign subsidiaries and a long history of local presence in export markets. Therefore, the most useful application of COO considerations applied to French exports in the context of the new Osez L’Export drive would seem to be in the identification of areas where France’s national brand attributes are most applicable to specific sectors, but where exports of French companies in this sector have not yet reached their full potential.

Before starting on such a list, however, it’s worthwhile to stand back and review what are France’s national brand attributes, as relevant to exports. The traditional ones – creativity, design, culture, elegance, sophistication, prestige – have been more lately joined by two new attributes, “quality” and “innovation,” which are valuable perceptions in further boosting the image of French products across a wide range of industries, including those with a more technical orientation.

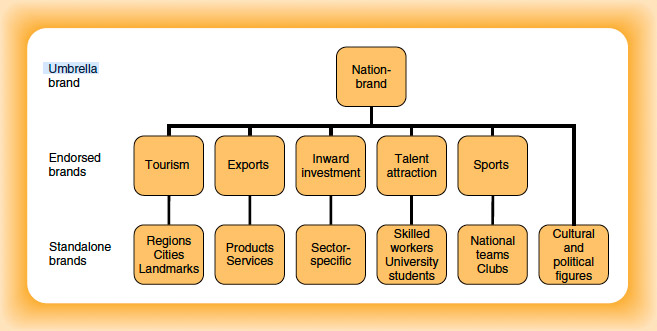

The Nation-Brand Architecture Model, from the book

One method of identifying promising areas for enhanced export support would be to filter the potential of underexploited export product sectors through the attributes mentioned above, both the traditional and the new, to see if they would be pertinent as positive COO factors for those products; and then to compare the export performance to date of those sectors or product niches with that of the like sectors of France’s “competitive set” of countries, particularly those which have achieved broad export success in those product categories.

A cursory combination of those two filters would result in targeting product sectors such as (to mention just three):

- Bicycles ($170m in annual exports from France vs $528m in imports). With the repression of motor vehicle traffic and the spread of cycle lanes across major world cities; the French reputation for manufacturing craftsmanship; the increasing worldwide popularity of cycle sports like BMX and mountain biking; and powerful sporting associations (the Tour de France; the Paris-Roubaix), there is ample potential for French bicycle brands to rival top-selling and exporting competitors in the higher end of the market. These include brands from the US (Trek, Connondale), Canada (Kona, Cervelo), Italy (Bianchi, Colnago), the UK (Raleigh), Spain (Orbea), Switzerland (BMC Switzerland) and Taiwan (Merida). The real prize to be seized, however, is in the export of electric-assisted bicycles. Here, in a rapidly growing worldwide market already worth $37.5 billion last year, European brands from Germany, Romania and the Netherlands have been able to compete with Asian manufacturers to rank among this lucrative niche market’s top 10 exporters.

- Olive oil. Increasingly valued by consumers and food service operators worldwide for its healthy qualities and taste, olive oil is a large ($14.6 billion in 2022 global sales) and growing agricultural product niche in which France, despite having some of the best olive oil in the world, takes a back seat to lead exporters Spain, Italy, Greece, Morocco, and Tunisia. While it may be hard to compete with the production cost structures of most of these countries at the lower end of the export market, much can still be done in the middle ranges – Italy’s Bertolli or Berio, for example, can be found in almost any U.S. supermarket – as well as, of course, the higher end of the market where France could establish itself as a leading exporter of organic small-batch gourmet oils. This could be achieved through greater promotion (perhaps in parallel with tourism promotion) of regional denominations like Nyons, Corsica, Nice, Nîmes, Aix-en-Provence, Haut Provence and Vallée des Baux-de-Provence.

A greater promotion of specific French olive varietals and “appellations,” like Nyons, may be needed for French olive oil to compete in export markets with the top Italian, Spanish and Greek premium olive oils.

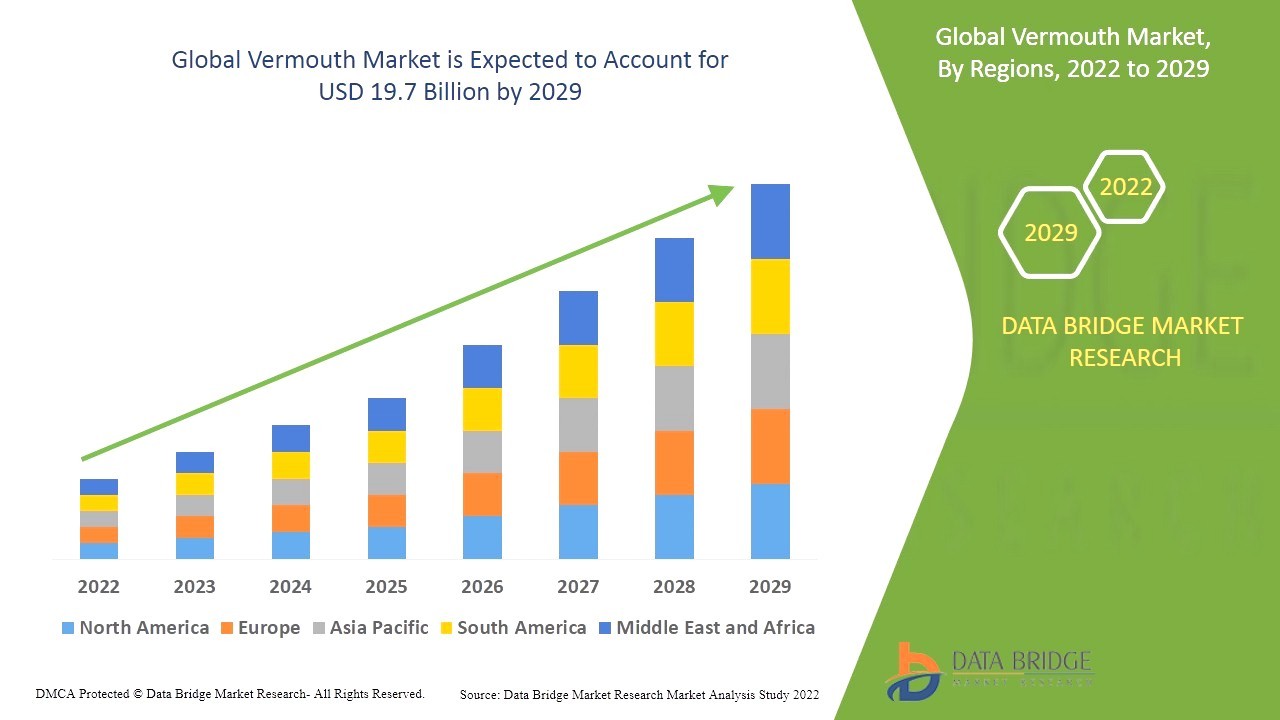

- Aperitifs. Long a smallish subset of the cocktail drinks category, and populated mostly by Italian commercial vermouth brands like Martini or alcoholic liqueur brands like Campari, the aperitif market exploded with the sudden worldwide popularity, starting about a decade ago, of the Aperol Spritz: a cocktail introduced in the 1950’s built around an Italian herb-based alcoholic concoction, Aperol, that dates back to 1919. The dominance of Italian brands in the aperitif market – those mentioned, as well as Cinzano, Crodino, Carpano, Cynar, and Cocchi – contrasts with French dominance in the after-dinner liqueurs market, with its Cognacs, Armagnacs, and Calvados. That said, French aperitif brands like Suze, Lillet or Avèze – not to mention the myriad of French vermouth brands, of which Noilly Prat (famously, the mandatory vermouth for a Dry Martini) and Dubonnet are the best-known, but which have been joined as of late by more confidential French brands like Guerin, Byrrh and La Quintinye – have been in the game for a long time, and have been exported, though never achieving the market penetration of the Italian brands. As with Aperol, creative ways of promoting these drinks in the context of innovative cocktails (including Champagne as an ingredient, the way Aperol is paired with Prosecco), backed by clever marketing, could power the international exports of these French brands.

The global market for Vermouth continues to grow steadily, and is one in which French brands both historic and recent have the potential to capture a larger share of market.

The French export landscape is a rich tapestry of smaller consumer brands in sectors beyond the country’s traditionally successful fashion, perfumery, food products, and wine industries. These brands have established themselves strongly in product niches consistent with the attributes of “Brand France” and have leveraged their reputation for quality, design and authenticity into worldwide export success. To cite just a few examples: Le Creuset in cookware, Laguiole in knives, Vuarnet in sunglasses, Vilebrequin in swimwear, Lacoste in sportswear, L’Occitane in natural beauty products, Christofle in tableware, Rossignol in sports (especially ski) equipment, Devialet in high-end audio equipment, Babolat in racquet sports equipment, Baccarat (and others) in crystal, Breguet and Bell & Ross in watches, and Bugatti in supercars.

This clever print ad for Le Creuset cookware is a good example of the French country brand attribute of Fashion being applied to a different product category in a convincing way.

All of the above brands embody that essence of “French flair” that is the best antidote to price competition from foreign competitors with lower production costs. They are export champions pointing at the enormous remaining potential of other French brands, across a wide range of categories, that can be unleashed with the help of the French government’s ambitious new Osez L’Export drive. The support programme, under the auspices of Team France Export, seems to have all the ingredients of a powerful initiative, as it will harness the resources and talents of large and very competent organizations – primarily Business France, CCI France and BpiFrance – already very active in this area.

#Osezlexport #teamfranceexport #export #madeinfrance #ccifrance #bpifrance #WAFIB #businessfrance #international #cci #PlanExport #France2030